Maximize the ROI of your content

Benefit from high technology that intelligently leverages thousands of Google data points and get the best SEO recommendations.

More than 400 companies around the world trust us

The solution dedicated to the best SEO & Content Marketing teams

Adopt an efficient and ROI-oriented content strategy.

A powerful and ROI-driven content strategy

Only 9%* of contents are visible on Google. With Semji, it’s 80%!

* Source: Ahrefs

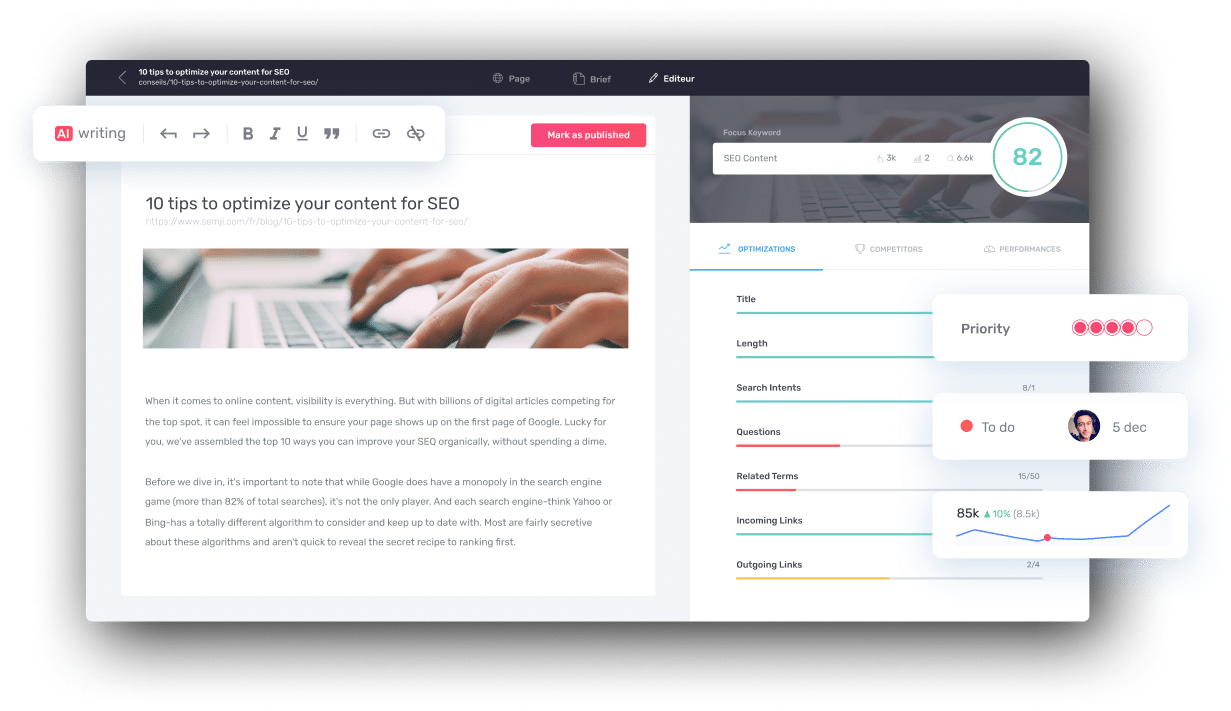

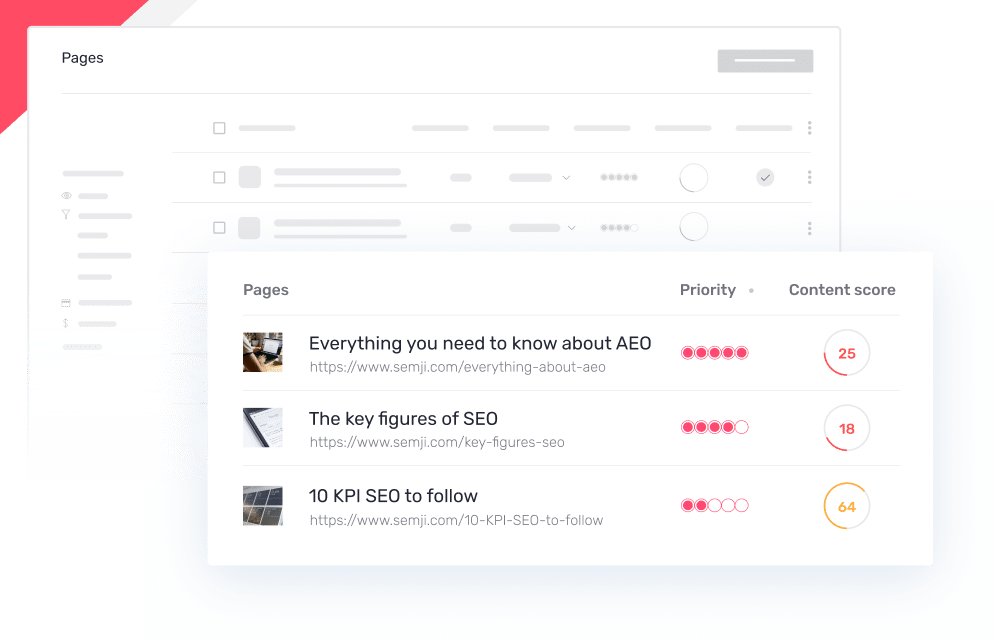

Optimize

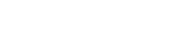

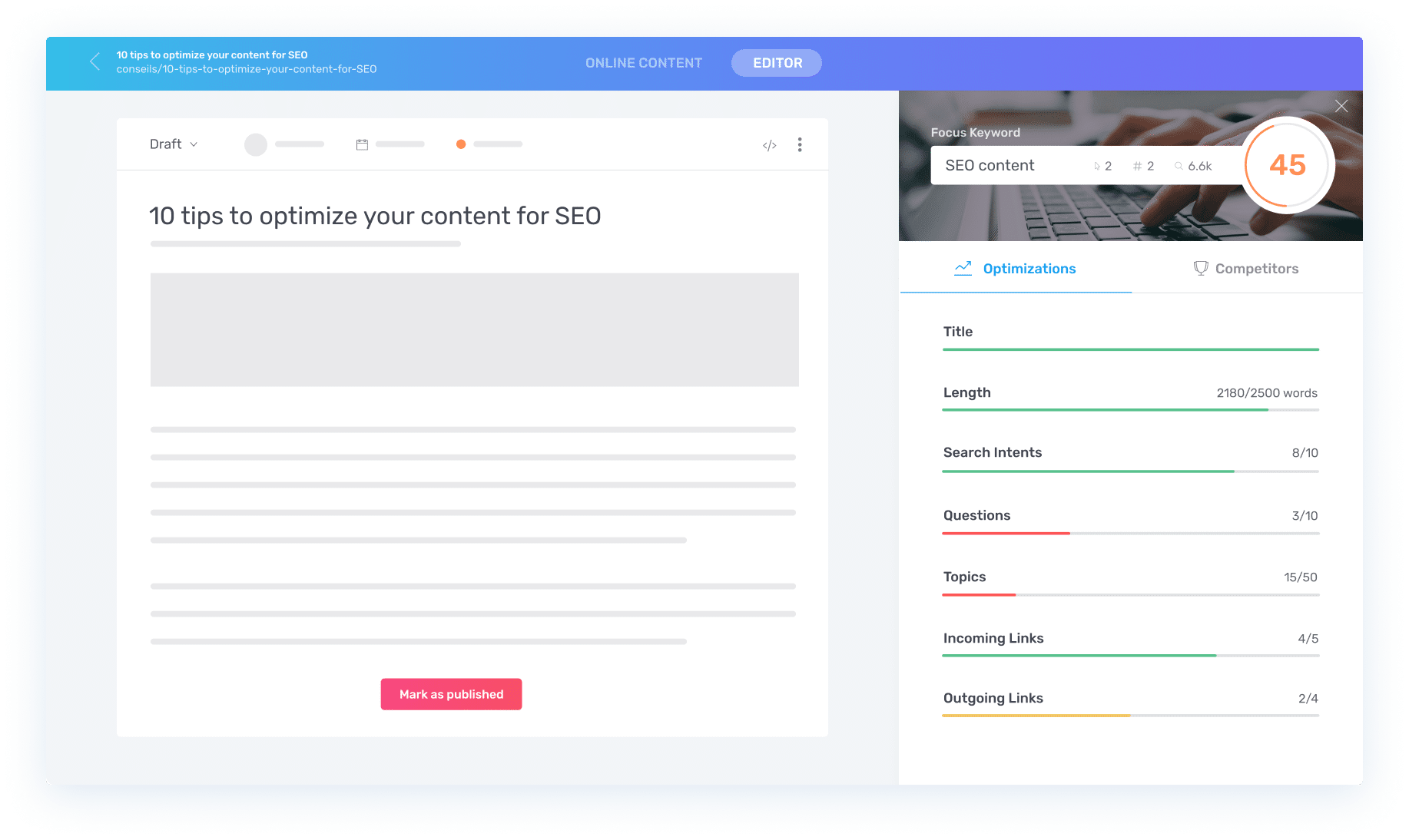

Deliver fully optimized SEO content

Outperform your competitors with 100% optimized content, which guarantees a good positioning on search engines and a satisfaction for your audience.

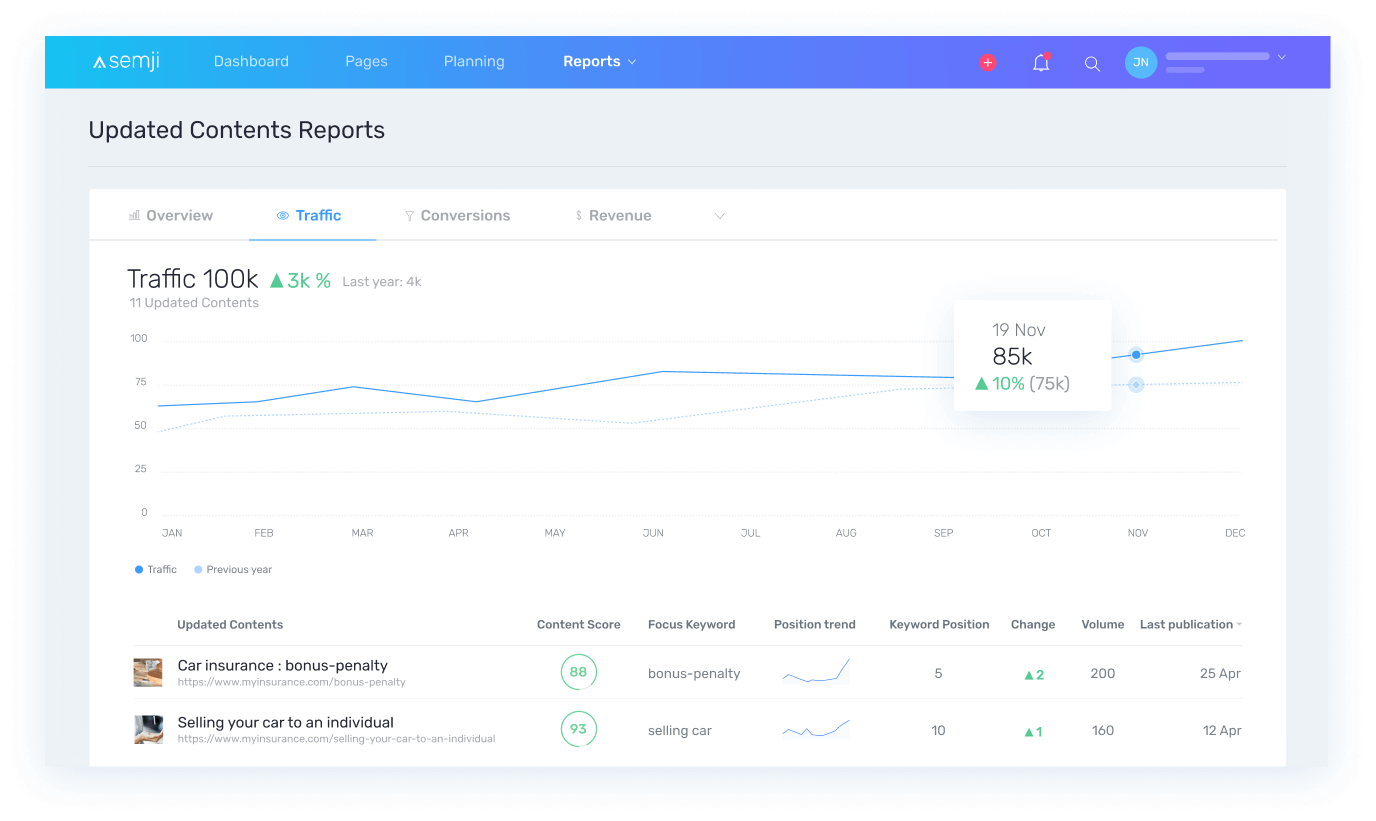

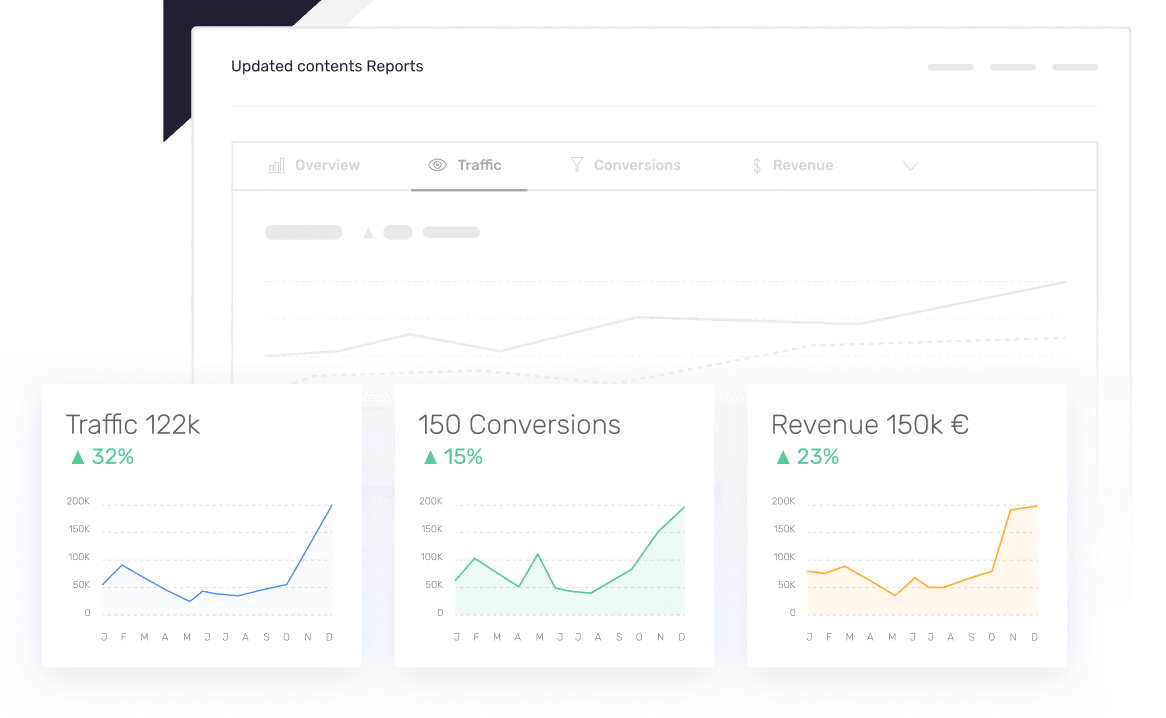

Monitor

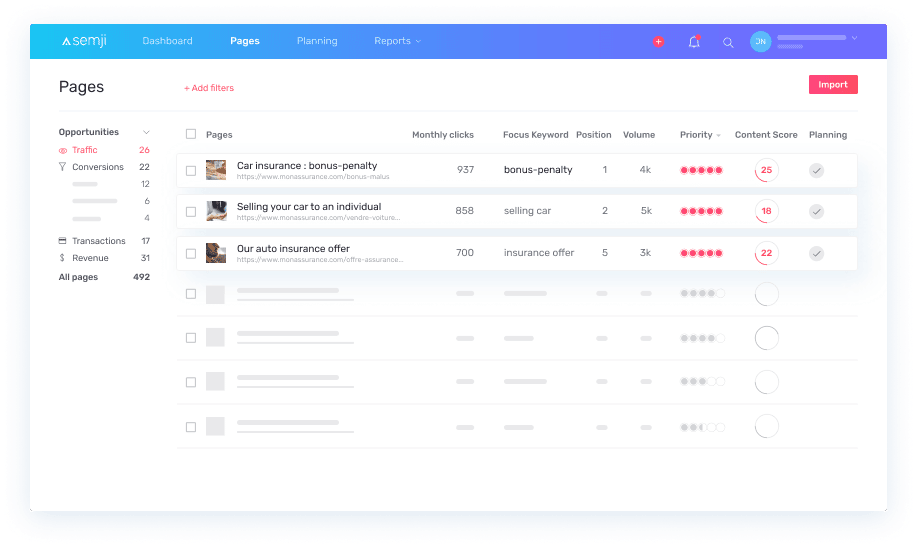

Get a clear view of the success of your content

Make your decisions easier by measuring the impact of your content to traffic, customer acquisition and sales.

Identify

Turn your content into a growth asset

Uncover new opportunities to boost your search rankings and exceed your growth goals.

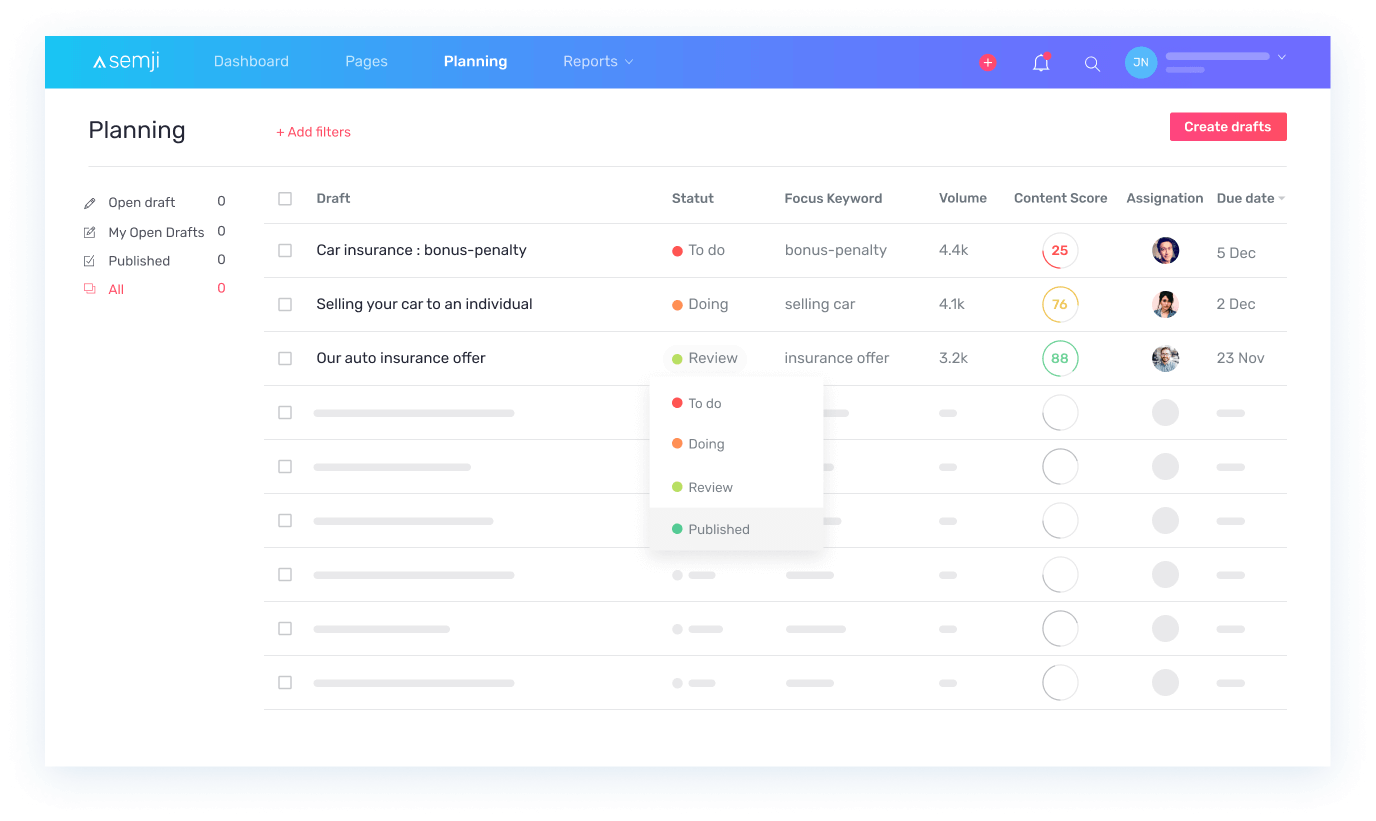

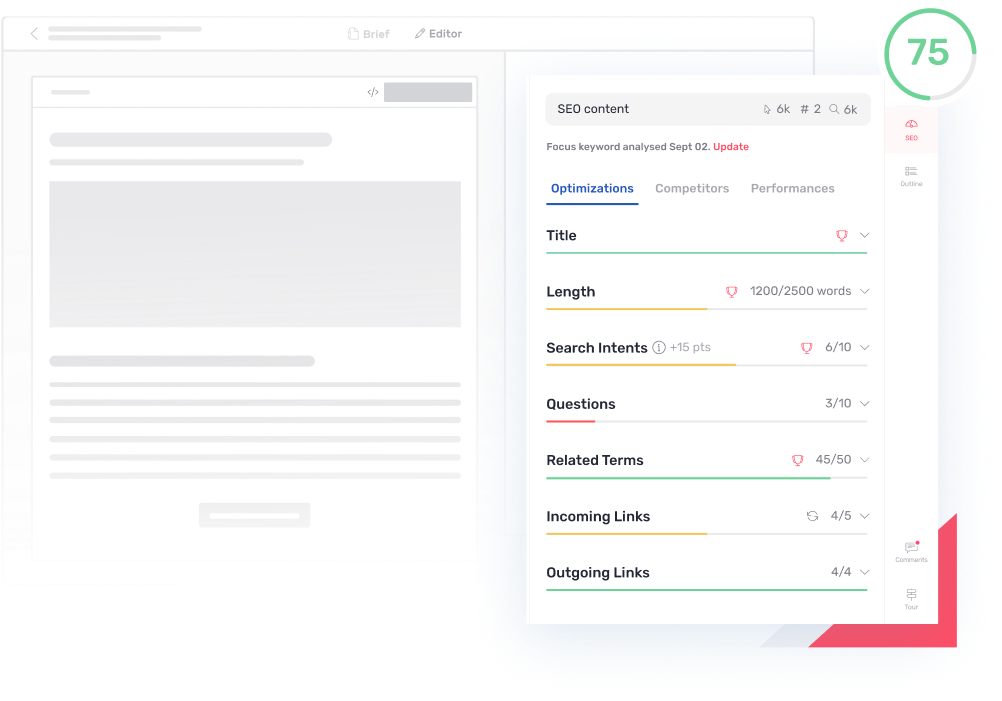

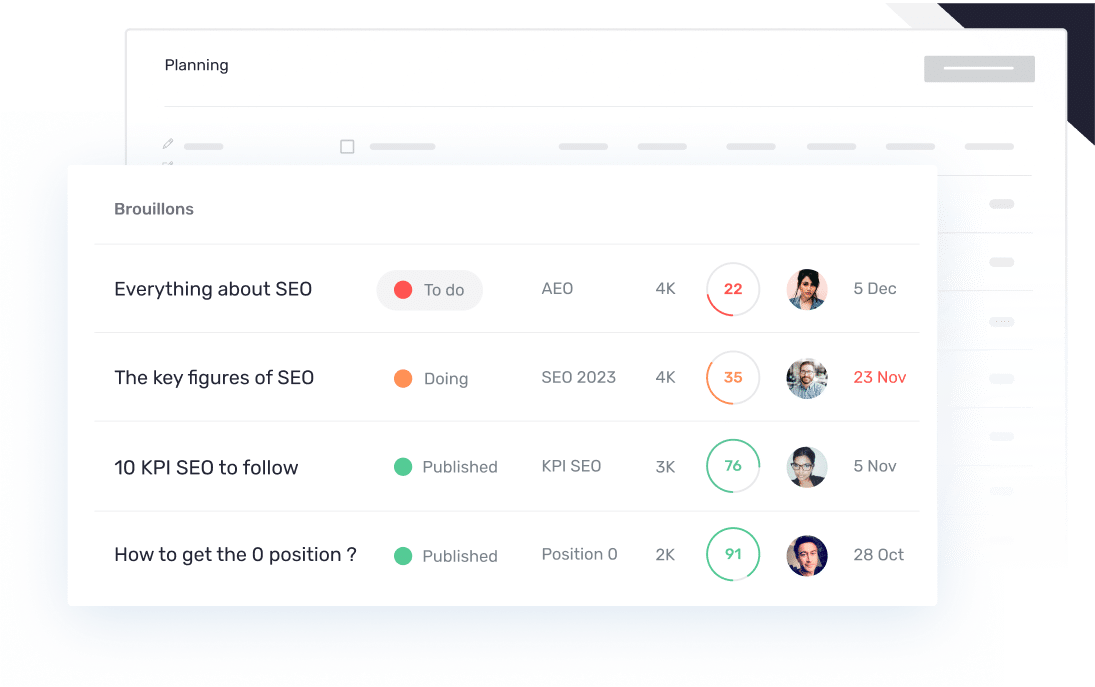

Plan

Boost your editorial team’s productivity

No more time-consuming content creation tasks, Semji increases team efficiency and productivity.

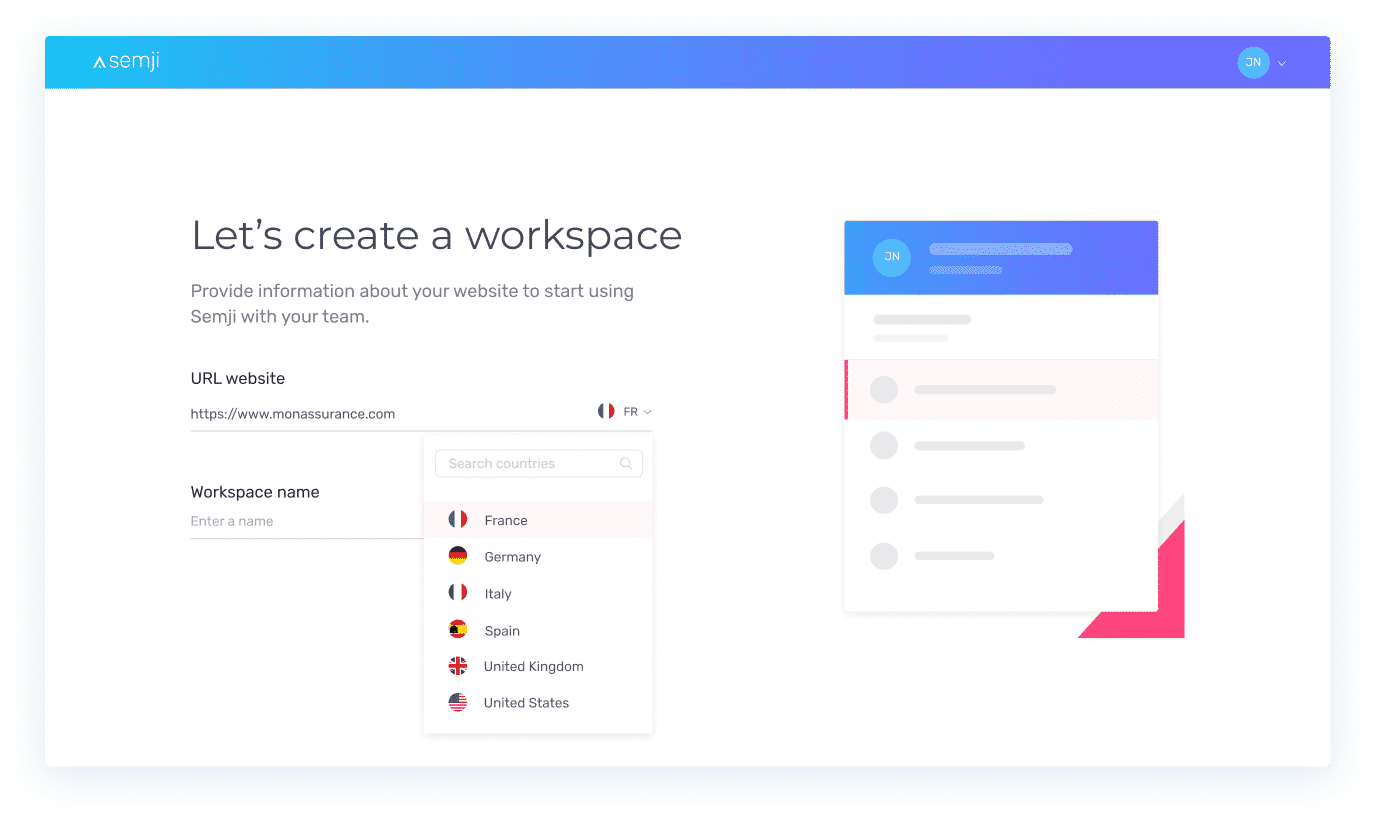

A leading SEO solution,

integrated with over 200 CMS and open-source solutions

Get all the power of Semji in your favorite softwares

NEW

AI Chat : the power of AI for your SEO strategy!

Designed for your SEO & Content Marketing needs, use this powerful feature to speed up your content production.

Semji, the #1 choice for the world’s biggest companies and teams with ambitious goals

The preferred SEO solution for leading companies in their market

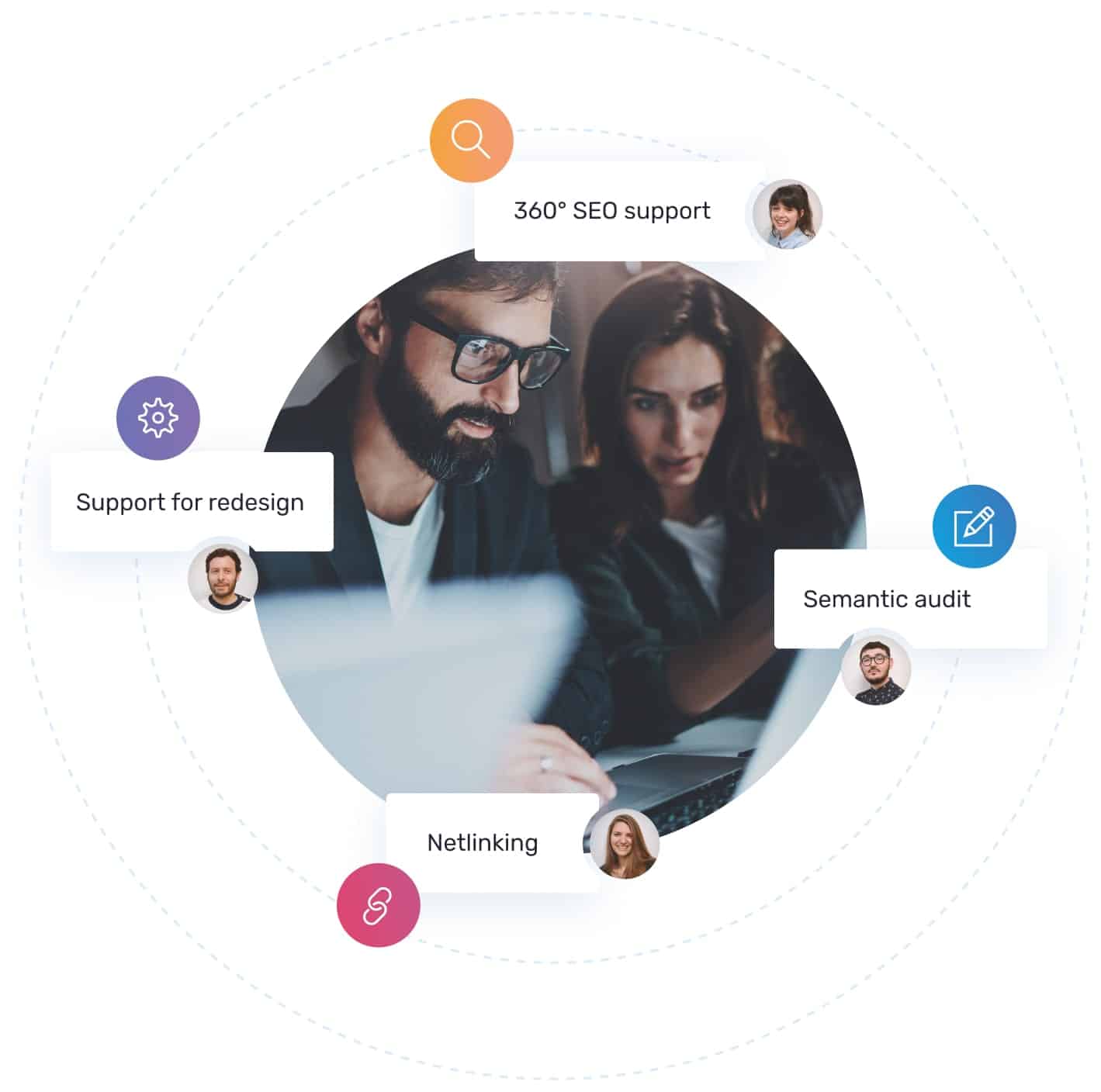

Services

SEO experts dedicated to your success

Our experts guide you to reach new heights of performance.

Quentin MAES I Head of e-commerce

resources

Our tips to drive the best traffic and business opportunities

Don’t Miss Out : SEO Square 7 Video Replays

Catch up now on the must-see event for SEO and Content Marketing strategy. Leading SEO experts provided exclusive game-changing insights on October 17-18 to maximize your success in the coming year.

You’re 1 click away from improving your SEO performance